Reach Us

Final year IEEE Projects

We offers latest ieee hardware and software projects in Java, Dotnet, Android and Php for all students…

- It Empowers Integration of Material learned in the Project center.

- Projects can be Developed own Idea for Individual Students.

- 100% Output Guaranteed

Mini Projects

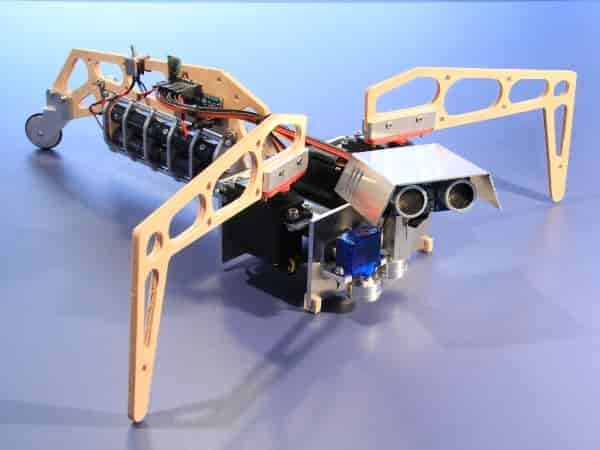

The Aim of Final Year Center is top experts & experienced staffs for all BE, BTech students & also available mini projects in Embedded, Vlsi, Matlab, etc

- Guide the Project Completely

- Timely Complete the Student Projects

- Advanced Concepts Used in Mini Projects

Application Projects

We are providing best final year application projects in Various domains like cloud computing, image processing, secure computing

- Online Project Delivery

- Highly Experienced Professionals

- Real Time IEEE and Non IEEE Projects Delivered

Diploma Projects

Tha main purpose of diploma Java, dotnet projects provides for all cse , IT students and also ECE,EEE students projects at low cost

- Project Requirement Specification

- Affordable Price

- Developed Student projects in latest Technologies

Welcome to Final Year Project ECE

1Crore Projects is the best project centre in chennai.1Crore Projects offers IEEE 2019-2020 Final Year Projects for CSE / IT Students in Java / dotnet / android / oracle, and Application Projects in PHP Platform.

Projects are doomed to take action as a connection between academic learning and handy execution. Working in Project gives the much needed hands on knowledge, judges your eligibility to document and present, and an opportunity

to work in group just similar to how it happens at Corporate. It should hand out as a stepping stone before one embarks on a corporate line of business. But miserably that is not how it works now-a-days. Projects are considered

just as a procedure before getting the Degree Certificate. We at 1Crore Projects are determined to formulate a change. We are confident you would be thankful for this change. Final Year Projects is

our latest contribution which would bring about this transform. So Why wait ? Walk in to our office today to get to know us better !

We 1Crore Projects are providing best final year application projects in Various domains like cloud computing, image processing, secure computing…

Department

Diploma Projects

Mini Projects

Application Projects

Diploma Projects

STUDENT’S TESTIMONIALS

ITS EASY, ITS BRILLIANT, IT WORKS!

In-Plant Training will be arranged

Smart class training & live project demonstration will be given

Student can feel workshop practice

Accommodation for outstation students will be arranged on request

Theroretical Review notes, Design Calculation, Project Report & Presentation will be provided

Hands on Training will be given by the experts for fabrication.